Power Your Business With Sunlight

COMMERCIAL FINANCING

It has never been easier and more affordable for businesses to transition to solar energy, thanks to an array of financing solutions custom-designed for every situation. The top lenders we work with combine federal, state, and local incentives with one of the available financing structures to create a plan that fits any budget. Start saving money by generating clean energy from the sun!

“Convert your monthly energy expense into a peak performing asset.”

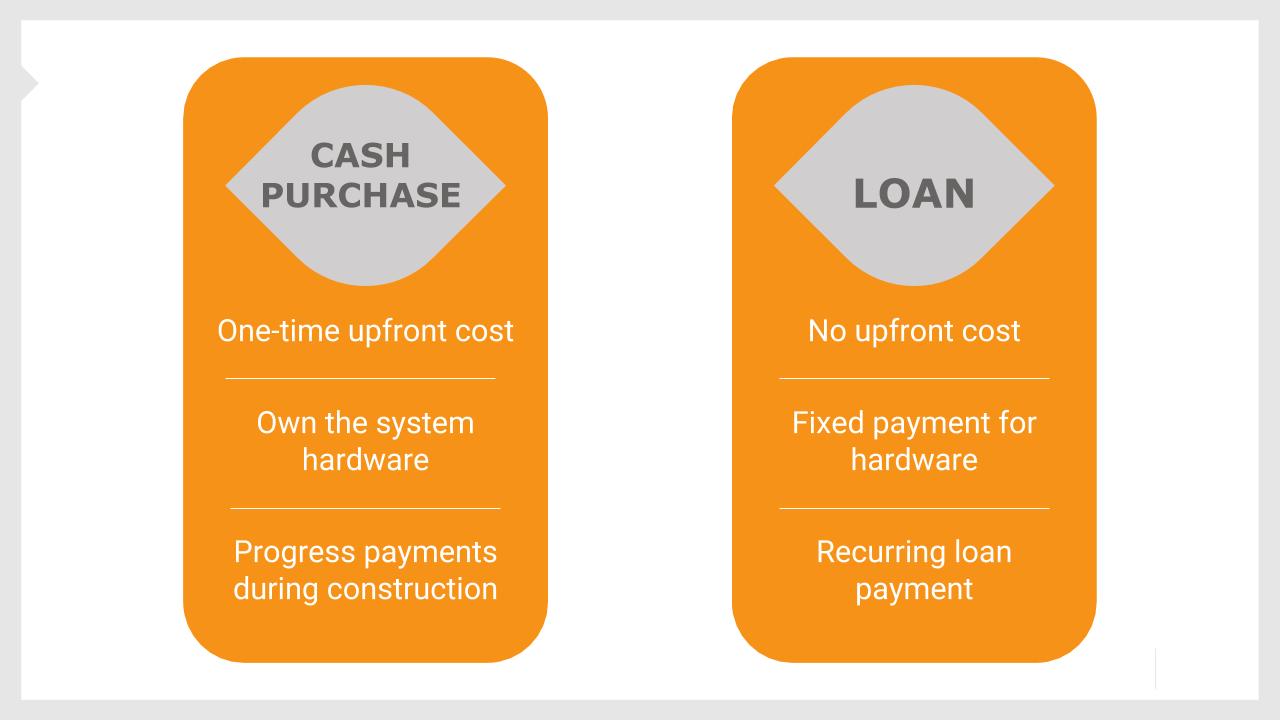

Cash and Loan Finance Options

Whether your company chooses to purchase a solar power system from Green Solar Technologies with cash or opts to finance with one of our many flexible loan options, our team of

finance experts are here to assist you with your decision. A solar loan enables you to begin enjoying the benefits of using renewable solar energy right away with no money down.

Competitive Commercial Pricing

One of the great benefits of our long-standing relationships with equipment manufacturers and lenders is that we are able to secure the best possible price for your solar power system and pass the savings on to you! We can efficiently manage your solar energy project and install a system that provides maximum savings—thanks to our skilled, experienced construction experts, technology infrastructure, and in-house design team—all without compromising the quality of the service and materials you receive.

PACE Financing

Property Assessed Clean Energy (PACE) is an ingenious tool for financing renewable energy improvements on private property. Local governments, state governments, and other

inter-jurisdictional authorities can use PACE programs to finance the up-front costs of improvements that allow their commercial and residential buildings to generate solar energy.

The cost is paid back over time by property owners, allowing for secure financing of wide-ranging projects for up to 20 years. PACE financing taps into private capital, such as

municipal bonds, and allows cities and towns to promote energy efficiency and renewable energy without having to use their general funds. Additionally, the interest portion

of assessment payments are tax-deductible, and the transaction costs are lower than those of private loans, making PACE an affordable financing option in multiple ways.

- Allows for secure financing of comprehensive projects over terms up to 20 years

- Repayment obligation passes with ownership, overcoming hesitancy to invest in payback

- Senior lien municipal financing may lead to low interest rates

- The interest portion of assessment repayments are tax-deductible

- Lower transaction costs compared to private loans

- Allows municipalities to encourage energy efficiency and renewable energy without putting their general funds at risk

- Taps into private capital, such as the municipal bond markets

PACE Financing

Still have questions about PACE Financing? No problem. Contact Green Solar Technologies today and let one of our experts walk you through how PACE can benefit your municipality’s transition to renewable energy.